Didim Property Insights

Your go-to source for the latest news and information on real estate in Didim.

Trading Like a Ninja: Secrets to Swinging Currency Moves

Unleash your inner ninja! Discover expert secrets to master swing trading and profit from currency moves like never before.

Mastering the Art of Swing Trading: 5 Essential Strategies

Mastering the Art of Swing Trading requires a combination of strategy, discipline, and market awareness. Swing trading aims to capitalize on short to medium-term price movements, making it essential for traders to identify key trends and patterns. To achieve success, traders must develop a robust trading plan that includes risk management and a clear understanding of their trading goals. Here are five essential strategies that can help you navigate the complexities of the market and enhance your swing trading skills:

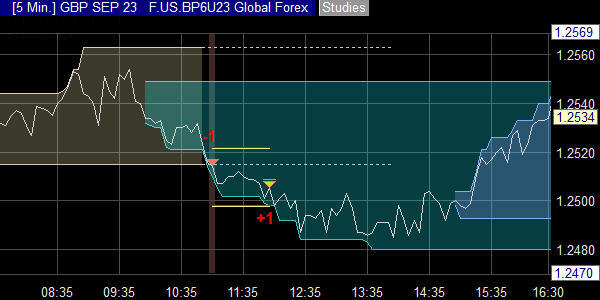

- Technical Analysis: Understanding chart patterns, trends, and indicators is critical for swing traders. Familiarize yourself with tools like moving averages, relative strength index (RSI), and Fibonacci retracement levels to identify potential entry and exit points.

- Risk Management: Always set your stop-loss orders and position sizes to protect your capital. This strategy allows you to limit your losses and preserve your account balance, enabling you to stay in the game longer.

- Market Sentiment: Gauge market mood and news events that can impact stock prices. Staying informed about earnings reports and economic indicators will help you make more informed trading decisions.

- Patience and Discipline: Wait for the right setup to enter or exit trades. Swing trading requires patience, as jumping into trades impulsively can lead to unnecessary losses.

- Continual Learning: The financial markets are always evolving. Keep refining your skills through books, courses, and mentorship to master swing trading.

What Are the Key Indicators for Successful Currency Swings?

When analyzing the key indicators for successful currency swings, traders often focus on economic indicators such as GDP growth, inflation rates, and employment statistics. These factors provide a foundation for understanding a country’s economic health and can influence currency strength. For instance, a rising GDP typically correlates with a strong currency, as it suggests robust economic activity. Additionally, inflation rates are crucial; high inflation may decrease purchasing power, leading to a weaker currency. Thus, monitoring these indicators consistently is essential for anticipating currency swings.

Another significant aspect to consider is market sentiment, which can drastically impact currency values. Sentiment is often shaped by news events, geopolitical developments, and other market dynamics. For example, favorable political news can lead to increased investment in a nation's assets, thus strengthening its currency. Moreover, technical analysis, including trending patterns and support/resistance levels, can provide traders with valuable insights into potential currency movements. By combining these factors, investors can better navigate the complexities of currency trading and capitalize on successful swings.

Understanding Currency Volatility: How to Trade Like a Ninja

Understanding currency volatility is crucial for traders who want to navigate the financial markets like true ninjas. Currency volatility refers to the degree of variation in economic value, which can lead to significant profits or losses in trading. To capitalize on these fluctuations, traders should familiarize themselves with key indicators such as economic reports, interest rates, and geopolitical events that influence currency movements. By doing so, they can develop effective strategies that allow for optimal entry and exit points, thereby minimizing risks while maximizing potential gains.

Successful trading in volatile markets also requires the implementation of robust risk management techniques. Traders should consider utilizing stop-loss orders and limit orders to protect their investments while they execute swift trades. Moreover, maintaining a disciplined approach and avoiding emotional decision-making is essential in this fast-paced environment. Remember, to trade like a ninja, one must stay stealthy and focused, adapting strategies as market conditions change. Embrace continuous learning and analysis, and watch your trading skills grow.